What exactly is Options Trading? A fundamental Assessment

Ties products and services offered thanks to Friend Dedicate Bonds LLC, affiliate FINRA/ SIPC. To own history to the Ally Purchase Securities visit FINRA’s Representative View. Consultative characteristics considering thanks to Ally Dedicate Advisors Inc., a registered investment agent. Ally Invest Advisers and you may Friend Invest Securities are wholly possessed subsidiaries away from Friend Economic Inc. Bonds items are Perhaps not FDIC Insured, Maybe not Financial Protected that will Eliminate Really worth. Friend Invest cannot offer taxation guidance and does not show in any manner that the effects discussed here will result in any type of income tax effects.

Immediate pro daypro | Tips trading choices inside 5 actions

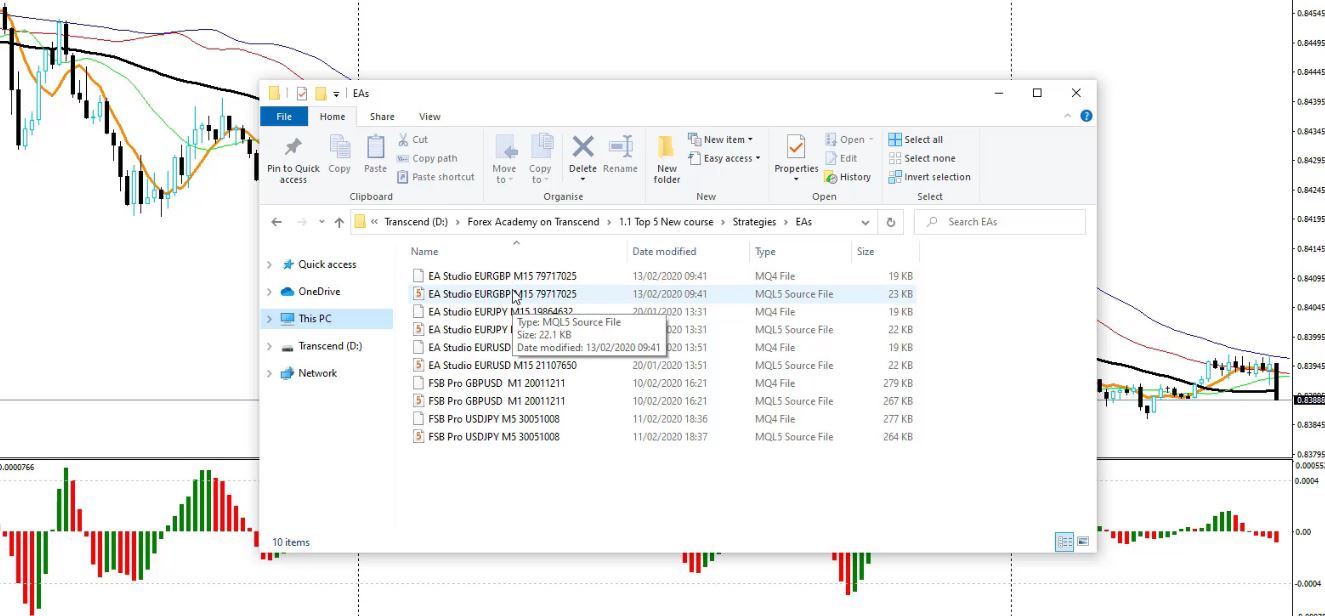

Make use of the broker research unit to compare more 150 additional account has and charges. Ok, once you have a manage on the some basic possibilities words, think strengthening an agenda that renders experience. When you are there is no precise strategy to need go after, we have found a broad 5-step plan to consider. Western financier Russell Sage developed the very first modern types of call and place options in the later 19th 100 years.

It’s important to remember that digital choices look far more such as playing than simply they do spending. Thus, it’s important to immediate pro daypro never wager over you’re also in a position to remove comfortably. A choice is the best, but not the obligation, to purchase or sell an inventory (or other asset) at the a particular rates from the a specific go out. An option have a definite life, having a fixed expiration time, and then its well worth is paid certainly alternatives traders, and the choice ceases in order to survive.

- You can set a bet on exactly how an inventory can do over time, next purchase an options offer you to reflects one to look at.

- So it reduces the risk of being forced to sell investment owed to help you monetary shocks.

- Options change try tempting because it can allow it to be a manager so you can create a bet on how a stock does instead of risking over the very first financing.

- Owners away from an american solution is exercise at any point right up to your expiry date whereas proprietors from Western european possibilities is only able to do it at the time away from expiration.

- Consequently solution owners promote the options in the industry, and writers purchase the positions back into close.

See a strategy

Inside means, the fresh individual buys a put solution in the anticipation of a decline on the hidden inventory. The fresh set choice offers the directly to offer the fresh inventory during the the new struck rate before conclusion. The new trader wants stock costs to fall for them to profit by selling over the market value. A lengthy set can also be used to hedge a long status regarding the hidden stock. Choices are monetary contracts that provides the brand new manager the authority to buy otherwise offer a monetary instrument from the a certain speed to own a specific time frame. Choices are readily available for numerous borrowing products, including stocks, finance, commodities, and you can spiders.

Paying your finances in the something you don’t understand is never a great smart financial circulate. Whether or not to like a call or an used alternative, and whether or not to buy otherwise sell, utilizes what you should reach since the a tips investor, claims Callahan. “It’s never best if you just come across a choice to possess their profile rather than shopping around and you will choosing even though they aligns together with your spending wants,” the guy teaches you. Somebody to shop for an ideas deal is long on one thing while they assume the new asset to execute in the way they require over the length of the choices bargain. The choice author, at the same time, does not consider the fresh investment is going to do in how the possibility manager wants, thus they’re quick. Before choosing an investing method, investors need a clear idea of the trade expectations, fundamentally whatever they’re also looking to to complete inside their on the internet exchange excursions.

Head an income

There may be a payment for for each and every change and a great percentage charged for each bargain. Paper trade makes you behavior cutting-edge trading tips, such as choices trade, which have fake cash before you exposure real cash. The brand new bequeath is profitable if the underlying advantage develops in price, but the upside is restricted as a result of the small-name strike. The main benefit, although not, would be the fact selling the greater hit call reduces the cost of purchasing the all the way down you to definitely.

The danger blogs out of choices is actually measured using five additional proportions referred to as “Greeks.” They’ve been the new delta, theta, gamma, and vega. Boxes is various other illustration of playing with options similar to this so you can perform a synthetic loan, an ideas bequeath you to definitely efficiently acts for example a zero-voucher bond up to it expires. But because the deposit locked inside the a predetermined speed, the buyer pays eight hundred,100. The potential homebuyer manage take advantage of the accessibility to to buy otherwise maybe not.

Follow these tips to determine and that student options trading strategy could work perfect for your overall method to exchange on the web. It’s vital that you think about the following the things to make certain they line up with your tips moving forward. It does be difficult to choose the best choices bargain for the method. Additionally, inside lifetime of an options package, items can change, impacting the probability of victory.

Trading possibilities might be immensely financially rewarding for those who know very well what they’lso are carrying out, however it can be greatly risky just in case you wear’t if you don’t those who just get caught inside the a detrimental trading. That’s why it’s vital that you understand the risks you’re running for these possible benefits, and you’ll need opt for on your own whether exchange options is a thing you should do. Of many buyers like carries over alternatives, because they can however create glamorous production along side long lasting, without the threat of complete losings on the choices.

Very binary possibilities tend to be the fresh province out of bettors which are prepared to endure the newest large threats. Any number of events produces industry unstable, and therefore strategy bets just on the volatility to boost, definition holds are more likely to circulate both high otherwise straight down. You could potentially bet both large or straight down, centered on your expectation of your field’s way.

Are brief an alternative setting your assemble the option premium right up front side. If the option ends worthless and you can OTM, you retain the option advanced collected in advance since the cash. Should your option has some kind of really worth prior to or during the conclusion, you can buy it straight back (or security they) for under that which you obtained to find out money. If you buy they back for more than everything you gathered in advance, which can trigger a knew losings. Making plans for your trade strategy very carefully prior to jumping to your options trading support you stay focused on your aims to reach their expectations, and it is essential on your change trip. Knowing the principles from alternatives trading and its particular risks is actually a steppingstone in order to advancing the market awareness, and therefore may help you control your collection risk finest.

Including, let’s state you are a traditional individual having extreme inventory collection and want to earn advanced income before businesses start reporting their quarterly money within the an excellent few weeks. You may also, hence, opt for a protected call writing method, that requires writing phone calls for the specific or all stocks on the portfolio. Low designed volatility setting lower option superior, that is perfect for to buy choices if an investor needs the brand new fundamental inventory usually circulate adequate to increase the property value the newest choices. Intended volatility lets you know if or not other people expect the new inventory to go a great deal or otherwise not.

Now, consider a situation the place you’ve wager one to XYZ’s inventory speed usually decline to 5. To help you hedge from this reputation, you’ve ordered call commodity, playing that stock’s rates will increase to 20. A visit choice gives the owner suitable, yet not the obligation, to purchase the root security at the struck rate for the or prior to conclusion. A call solution tend to for this reason become more worthwhile because the underlying shelter goes up in cost (calls have a positive delta). Guessing which have a label choice—rather than buying the inventory outright—wil attract for some people because the alternatives give leverage. An out-of-the-money label choice might only rates several dollars or even dollars weighed against the full price of a good one hundred inventory.

How old you are and life phase notably feeling when to buy brings. Essentially, young investors can be spend some far more to help you stocks since they have enough time to come out of field downturns. Since the senior years techniques, gradually moving on some property so you can much more conventional investments is practical. Although not, actually retirees normally take advantage of keeping specific stock exposure to own growth possible and you can rising prices protection. Before you can place your trade, you have to know what you should trading, and that can require a lot of works. You’ll need to see the business your’re considering exchange possibilities within the, to be able to build a sensible choice.